If you have an existing American Express Card with an annual fee, follow the simple steps below to determine if your annual fees are being waived

Check to See if American Express Is Waiving Your Fees

sparechangeinvestments.com

Importance of Being a Covered Borrower

In order to be considered a ‘Covered Borrower’ and have your credit card annual fees waived, you must either qualify under Military Lending Act (MLA), or Servicemembers Civil Relief Act (SCRA).

The necessary requirements to be eligible for either are listed below:

- MLA: Meaning that BEFORE you applied for the card, you have been under Active Duty status longer than 30+ days.

- SCRA: Meaning that AFTER you applied for the card, you entered Active Duty status, then applied for the benefits retroactively.

Discovering Whether You Are a Covered Borrower

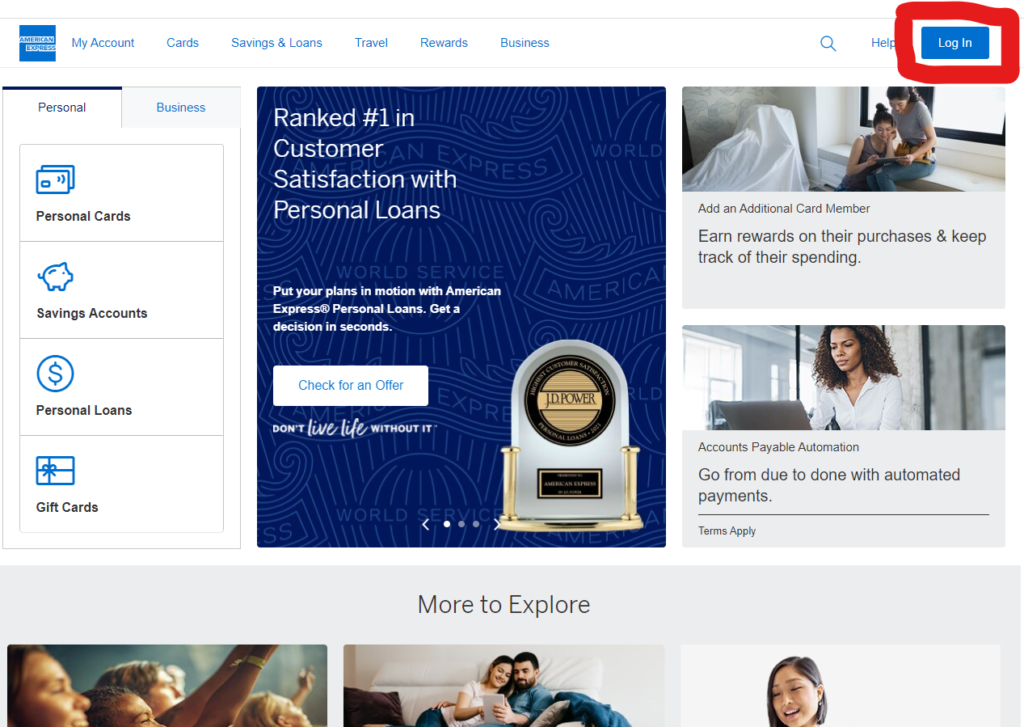

Step 1: Logging into your American Express Account

First, navigate to Americanexpress.com, and click on the ‘Login’ option highlighted in the upper right-hand corner.

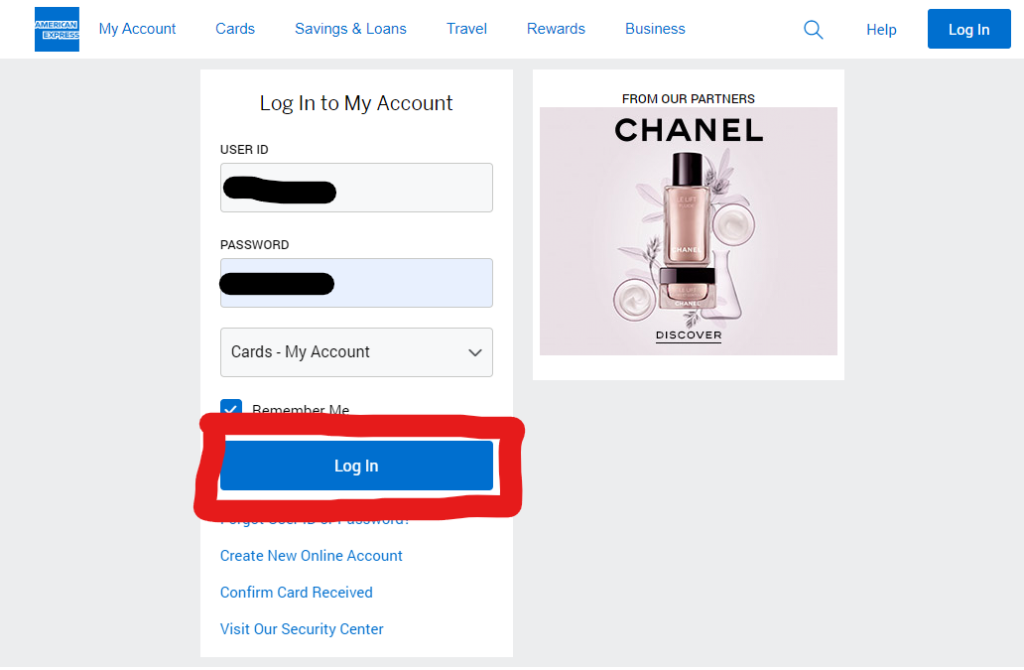

Step 2: Entering Credentials

Simply enter your appropriate account information into the boxes, follow by clicking the ‘Login’ button highlighted below.

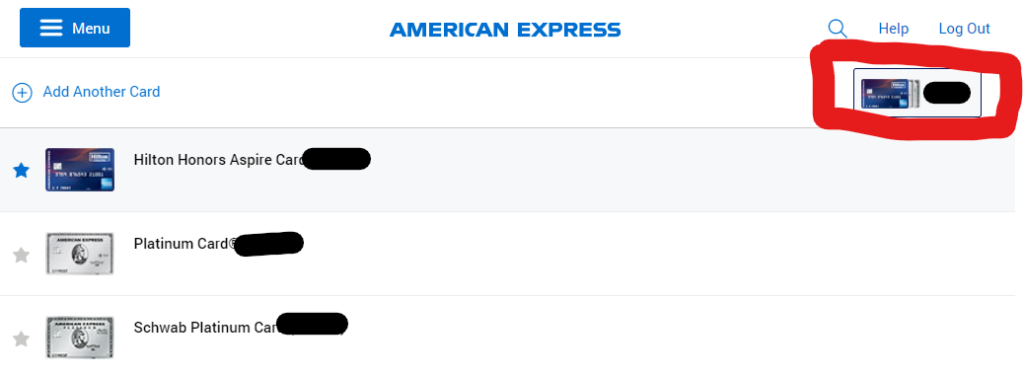

Step 3: Choosing the Card to Check

Once logged in, you will then navigate to the upper right-hand corner to the picture of various credit cards you have with American Express.

While it shows my top three cards, (2 American Express Platinum cards, and 1 American Express Hilton Aspire card), it will show you whatever cards you own from AMEX.

Click on the card you’d like to check the annual fee status for. In this case, I will use my American Express Platinum as an example.

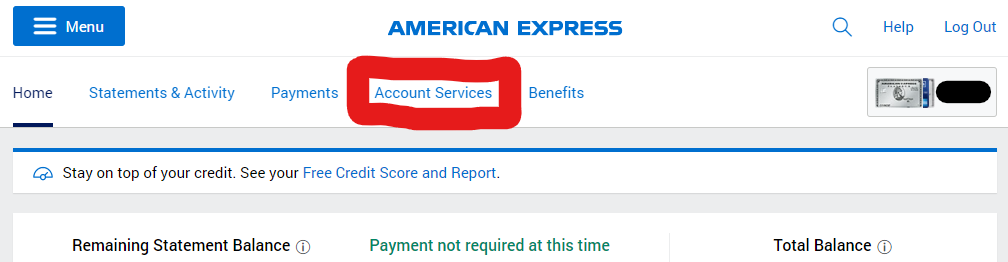

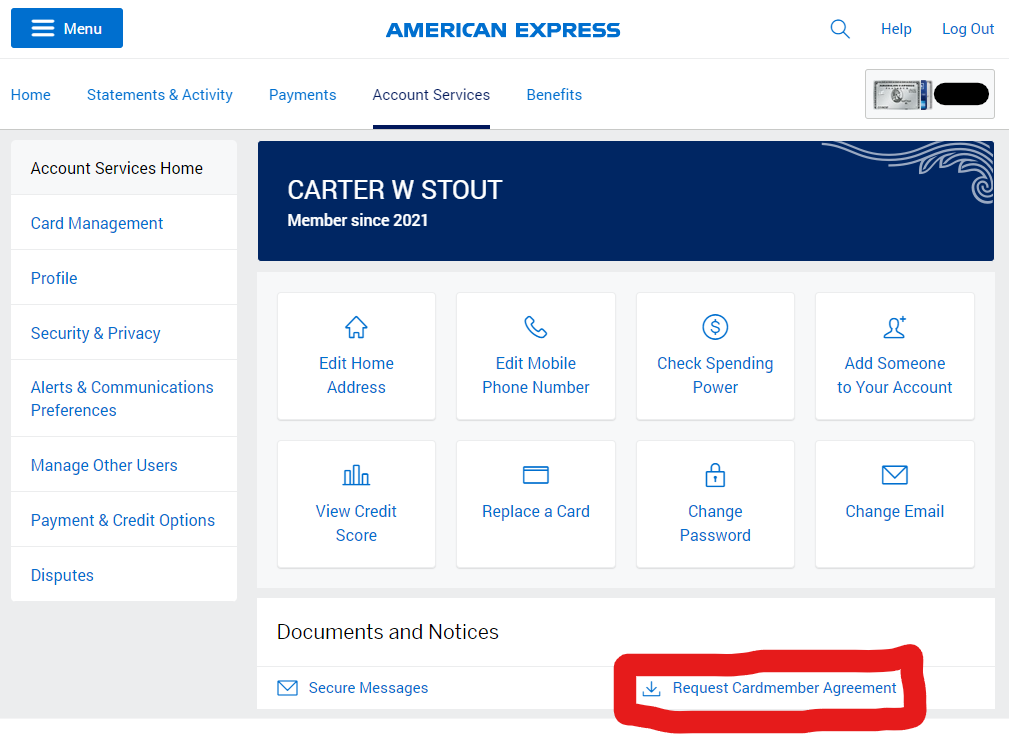

Step 4: Accessing Account Services

After you have chosen a card to check, navigate to the ‘Account Services’ tab along the upper menu bar.

Step 5: Request Cardmember Agreement

After you have accessed the Account Services tab, scroll down to the bottom of the page where you will see a download option that says, ‘Request Cardmember Agreement’. Click this button to begin the download.

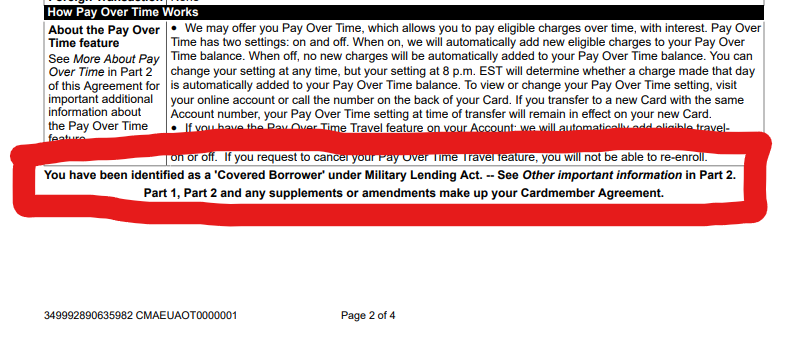

Step 6: Understanding Your Cardmember Agreement

In this document, you will find loads of information from your APR rate, cash advances, annual fees, etc.

On the bottom of Page 2 is where you will find the pertinent info regarding Military Lending Act status. I have included my document as an example of what a successful annual fee waiver looks like.

If your cardmember agreement is lacking the section stating, ‘You have been identified as a ‘Covered Borrower’, but you are currently serving on active duty, you have to two options to remedy the situation.

- If you got the credit card before going on active duty status, you can apply for SCRA benefits in the same portal.

- If you got the card after you entered Active Duty, there was either an error in the system, or you jumped the gun and applied before you were officially on the MLA registry. In either case, call the number on the back of your card, and discuss your situation with a customer service representative to get the annual fee waived.

Conclusion

Acquiring luxury credit cards with thousands of dollars of cashback can be exciting.

What’s not exciting is the first month of anxiously waiting to see if you are hit with the annual fee.

This guide serves as an easy way to give yourself peace of mind and learn of the status of any errors so you can fix them BEFORE fees are posted to your account.