The SCRA has many benefits for servicemembers. If you are an active duty service member you should be avoiding annual fees for the rest of your career.

SCRA Credit Card Benefits: See If You Qualify

Sparechangeinvestments.com

Table of Contents

Servicemembers Civil Relief Act (SCRA) Explained

Active duty service members became eligible for the Servicemembers Civil Relief Act (SRCA) back in 2003, granting them special financial relief and protections.

The act grants various benefits such as:

- Credit card interest rates capped at 6%

- Termination of rental agreements, auto leases, and phone services (in event of deployment/PCS)

- Voting rights maintained when away

- Postponed civil Judicial proceedings

- Annual fees waived on credit cards by American Express and Chase Bank

While the SCRA has a ton of useful protections for service members, in this article we will be focusing on the benefits associated with waiving annual fees on credit cards.

Who Qualifies For The Servicemembers Civil Relief Act (SCRA)?

All branches for active-duty military members are covered, including service members in the Army, Air Force, Coast Guard, Marine Corps, Navy, National Guard, and yes, even the Space Force.

Reservists: While the SCRA benefits can be extended to reservists, it only applies to them when on active duty orders.

Dependents: SCRA will also apply to spouses and children of the qualified servicemember. This means that not only will the service member get their annual fees waived, but their spouse will as well! Churning credit cards with your spouse will double your benefits.

Annual Fee Refunds

Another lesser-known benefit of the SCRA is that American Express and Chase will often refund annual fees for credit cards obtained prior to the active-duty members’ service.

As an example, let’s say you have an individual who held the American Express Platinum card for 8 years. In that time, they paid the $550 annual fee every year, bringing their total annual fees to $4,400. ( 8 x $550 = $4,400 )

If they then chose to enter active duty service and applied for SCRA benefits through American Express, there are cases where American Express will refund them the full $4,400 in fees!

Applying For SCRA Benefits

Both Chase Bank and American Express will allow you to apply for SCRA benefits on any of your cards.

For simplicity’s sake, I will stick with American Express, and show you the steps to apply.

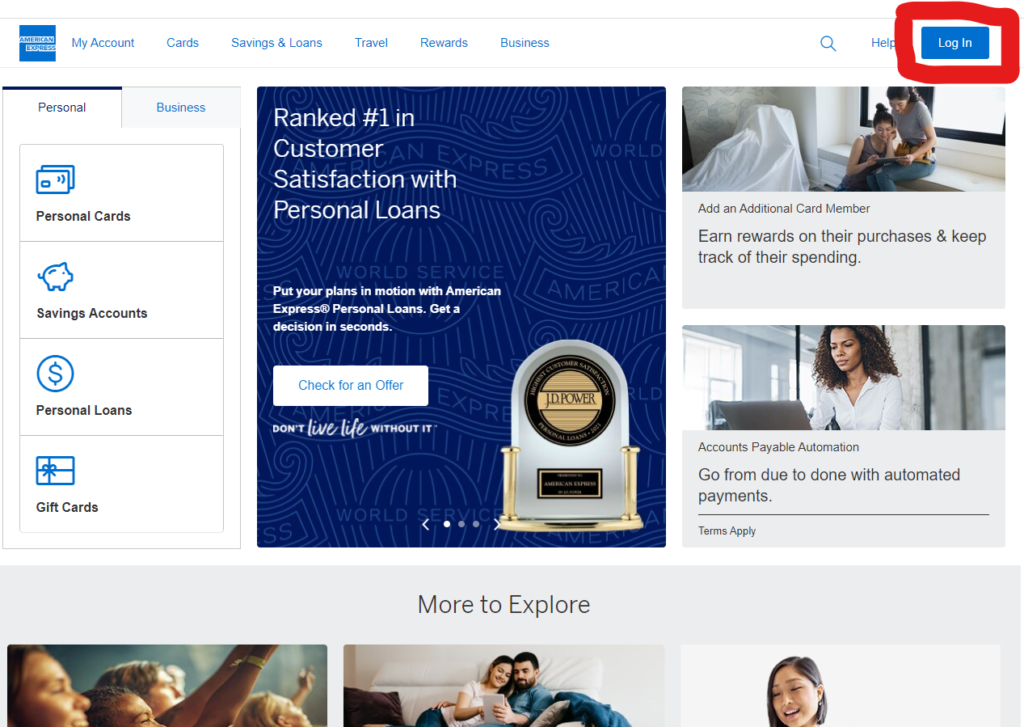

Step 1: Logging into your American Express Account

First, navigate to Americanexpress.com, and click on the ‘Log In’ option highlighted in the upper right-hand corner.

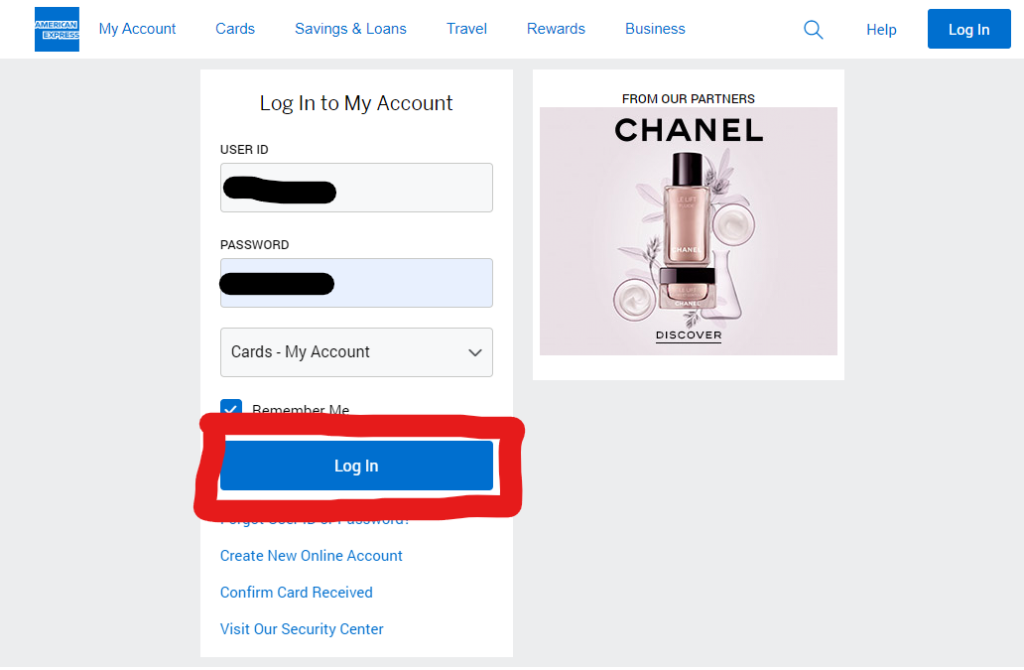

Step 2: Entering Credentials

Simply enter your appropriate account information into the boxes, follow by clicking the ‘Login’ button highlighted below.

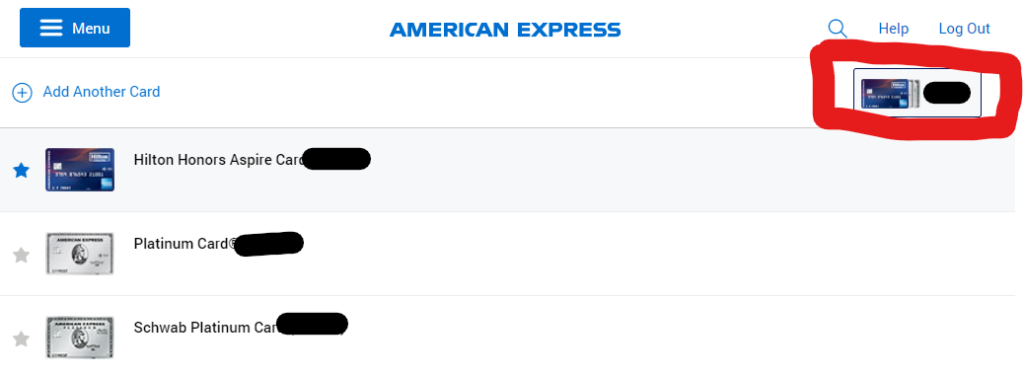

Step 3: Choosing the Card to Apply Benefits to

Once logged in, you will then navigate to the upper right-hand corner to the picture of various credit cards you have with American Express.

While it shows my top three cards, (2 American Express Platinum cards, and 1 American Express Hilton Aspire card), it will show you whatever cards you own from AMEX.

Click on the card you’d like to apply SCRA benefits to. In this case, I will use my American Express Platinum as an example.

Step 4: Navigate to ‘Account Services’ Tab

Next, first click on the ‘Account Services’ Tab on the top navigation screen.

Followed by clicking the ‘Payment & Credit Options’ on the left-hand screen.

Finally clicking on the ‘Servicemembers Civil Relief Act (SCRA) Benefits’ option.

Step 5: Submitting Application

Once you click on the ‘Servicemembers Civil Relief Act (SCRA) Benefits’ option, it will take you to a new screen called credit management where you can easily apply for benefits on the card.

It will ask you a few short questions regarding when you entered active-duty status, and then you should hear back in roughly 6+ weeks.

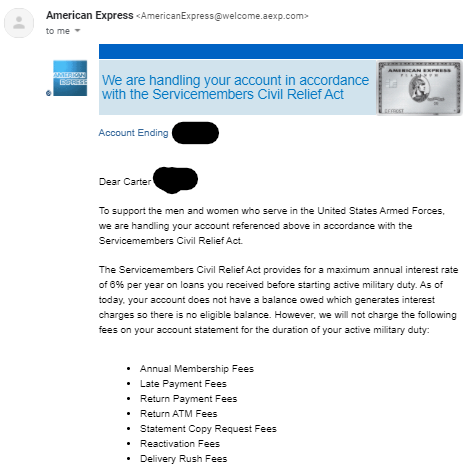

If you are successful in being granted benefits, you will be sent an email similar to the one I received for my Platinum card:

SCRA Benefits vs MLA Benefits

It is quite common for beginners to have a hard time understanding the difference between SCRA & MLA, and which one applies to them.

Whether you are covered under MLA or SRCA benefits relies entirely on when you entered active duty service in relation to when you acquired the credit card.

- MLA: Applies when you acquired the credit card after entering active duty service.

- SCRA: Applies when you acquired the credit card before entering active duty service.

Summary

SCRA and MLA benefits alike provide a multitude of protections and benefits to men and women in uniform. One of the principal benefits is credit card annual fee waivers.

Once you understand which act you are covered under, and how these benefits can be applied to your account, you can join thousands of service members who take advantage of thousands of dollars in free travel, hotel stays, and cash back each year.