If you are a service member, you’ve probably been told you should be investing in your TSP account. Learning how the Thrift Savings Plan (TSP) works may seem intimidating at first, but with just a bit of effort, you can understand it in no time.

The federal government’s Thrift Savings Plan is the largest 401(k) in the US both by the number of participants, and the total amount of money invested. The plan offers incredible tax-advantaged investment opportunities and employer contribution matching at some of the lowest expense ratios (cost) in the business. By properly setting up your TSP account early, you can accumulate millions of dollars by the end of your career.

Thrift Savings Plan (TSP): The Ultimate Guide

sparechangeinvestments.com

Table of Contents

Thrift Savings Plan Eligibility Requirements

While our site mostly focuses on content for active-duty service members, they are not the only ones eligible for the Thrift Savings Plan (TSP). Those who are able to invest in the TSP plan are:

- FERS Employees: These are employees under the Federal Employee Retirement System

- CSRS Employees: These are employees under the Civil Service Retirement Act

- Uniformed Services: This includes both active-duty, as well as the ready reserves

- Other Goverment Service: A broad category that includes civilians in various other jobs

The large majority of those employed by the US government will be eligible for the TSP.

Vesting Requirements

Being considered “vested” simply means that you are entitled to ALL of the money in your TSP account.

While the money that you personally contribute from your paycheck is always yours, the money your employer contributes on your behalf isn’t yours until you are vested.

While for certain employees such as FERS it may require up to 3 years before being considered vested, uniformed servicemembers are automatically considered vested from day 1.

In other words, you are entitled to the free money the government contributed on your behalf regardless of your total time served!

Why You Should Invest in the TSP

Simply put, the Thrift Savings Plan has the potential to make you millions of dollars.

Granted, this isn’t some get-rich-quick scheme. You won’t wake up one day surrounded by yachts, giant piles of money, and beautiful women.

Instead, this money will be tucked away into your Thrift Savings Plan (TSP) little by little, as compound interest works its’ magic over the years. It may not seem like the most glamorous option on the path to wealth, but it is by far the most common for military members to become wealthy.

A common argument against investing in your TSP from some service members is:

Why do I need to invest in my TSP if I am just going to serve my 20 years and get the pension?

The answer is two-fold.

- Only 17% of active-duty service members manage to make it to the 20 year mark.

- The pension alone may not be enough to retire on.

Unlike other government jobs, the military requires that you continually promote in order to continue serving.

So even if you plan on serving out your 20, reality may have other plans. Even if you do get the pension, oftentimes it may be $40,000 or less, especially if you retire at exactly 20 years. If you are the sole income provider, you will often need more money if you wish to sustain your current quality of life.

The Thrift Savings Plan (TSP) can either be your sole source of income in retirement, or it can help pad your pension in order to provide you a higher quality of life.

TSP Portfolio Simulation

Demonstrating the power of the Thrift Savings Plan (TSP), a quick simulation shows your approximate TSP value over the years, at various contributions percentages.

An important thing to keep in mind is that these values only display 5%, 10%, and 15% of your paycheck. A large number of servicemembers can easily contribute 20% or even 25% of their paychecks. If your situation allows for 20%+ contributions, you will likely find yourself breaking the $1,000,000 barrier at some point throughout your career.

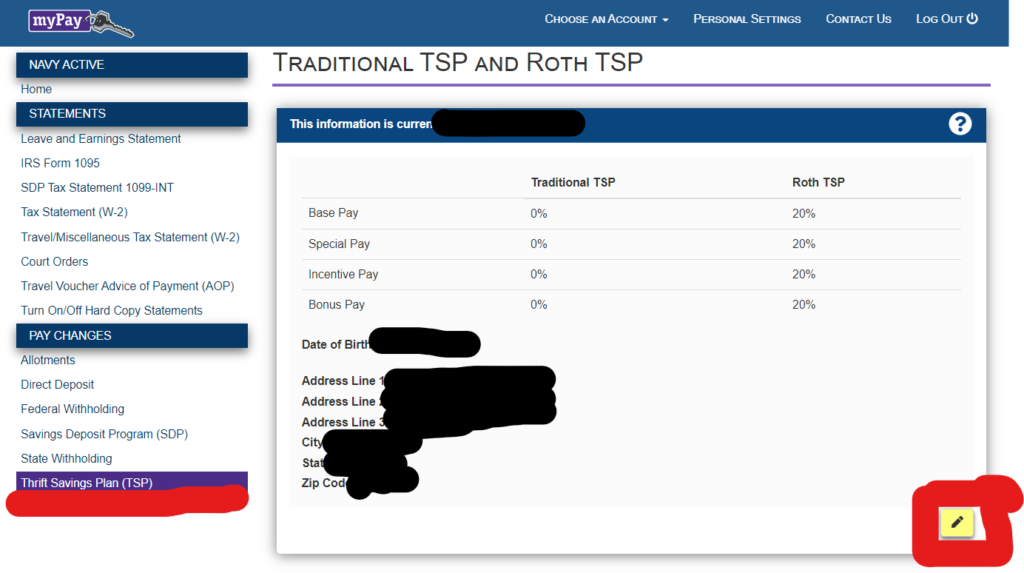

How to Adjust Contributions (mypay)

Adjusting your contribution into your TSP from your paycheck takes just a few minutes, although 30 days must past before they are put into effect.

STEP 1: Log Onto Your myPay Account

Navigate to https://mypay.dfas.mil/#/.

STEP 2: Navigate to Thrift Savings Plan, and Edit Contributions

Employer Contribution Matching

When it comes to your Thrift Savings Plan (TSP), the government will put extra money in on your behalf. This is free money that can drastically increase your money in retirement.

The government will match 100% of your contributions on the first 3% of your paycheck, and then match 50% of your contributions on the next 2% of your paycheck. This means that at an absolute minimum you should contribute 5% in order to utilize the full value of the match. That being said, you should always aim for more than 5%.

| Your Contribution | Automatic Contribution | Agency Matching Contribution | Total Contribution |

| 0% | 1% | 0% | 1% |

| 1% | 1% | 1% | 3% |

| 2% | 1% | 2% | 5% |

| 3% | 1% | 3% | 7% |

| 4% | 1% | 3.5% | 8.5% |

| 5% | 1% | 4% | 10% |

| 5%+ | 1% | 4% | 10% + Extra |

Contribution Limits

The max you are allowed to contribute in a single year is $19,500 to your TSP, as a combination of both your and your employer’s contributions. The only exception to this rule is that if you are over the age of 50+, you may contribute an additional $6,500 in “catch-up contributions”, bringing your total to $26,000.

It is important to be aware of this contribution limit to ensure you don’t miss out on some of the potential TSP match.

For example, let’s say you are able to live under your means and contribute $2,000+ per month to your TSP. This means that during months 11 and 12, you would be barred from further monthly contributions. Since matching occurs on a monthly basis and not annually, you would effectively ‘miss’ those matching months.

TSP Spillover

Beginning in January of 2021, service members who are over the age of 50+ will no longer be required to contribute their previously discussed $6,500 “catchup contributions” into a separate account. They can simply continue contributing as usual and it will automatically choose the correct account.

Pay Excluded From TSP

Not all pay is eligible to be contributed to your TSP account. Only your ‘basic pay’ can be contributed, so this means that other pay sources are not counted. Excluded payments are things like:

- Bonuses

- Allowances

- Lump-sum leave payments

This means you are not able to use the money allotted for, say, Basic Housing Allowance (BAH) towards your TSP. This also prevents you from receiving a large bonus, and easily maxing out or exceeding the TSP contribution amount.

Fund Options

So where is the money in your TSP account going anyway?

There are a total of 5 different fund categories, and 10 different ‘lifecycle’ choices available for you to choose from.

G Fund

The G-fund stands for the “Government Securities Investment Fund“, where the goal of the fund is to ensure the preservation of capital and generate returns above those of short-term U.S. Treasury securities.

While the fund does boast nearly zero risks, the lack of risk is accompanied by a lack of returns. This fund’s return can hardly beat a savings account interest rate, let alone inflation. Thankfully, this is no longer the TSP’s default fund, which in the past cost many servicemembers millions in lost gains.

You should avoid holding your money in the G-Fund. Your Thrift Savings Plan (TSP) should be a place to earn considerable compound gains, not as a place to leave your money to stagnate.

1.15% return in 2020

F Fund

The F-fund stands for the “Fixed Income Index Investment Fund”, where the goal of the fund is to match the performance of the Bloomberg Barclays U.S. Aggregate Bond Index.

This fund is typical of what you will find in an aggregate bond index. Generally speaking, the bond index won’t be able to give you the same rate of returns as the stock indexes, but it can be useful for limiting volatility in your portfolio.

The decision whether or not to hold any portion of your portfolio in the F-fund should be based on whether you get nervous during downswings, or are close to retirement. If so, holding the F-fund can reduce volatility at the expense of losing growth.

0.12% return in 2020.

C Fund

The C-fund stands for the “Common Stock Index Investment Fund“, where the goal of the fund is to match the performance of the Standard and Poor’s 500 (S&P 500) Index.

Holding what is essentially a copycat of the S&P 500 will bring you strong economic gains from the largest companies, without all of the needless speculations.

This fund should compose the majority of your TSP portfolio, somewhere between 60-80%.

31.13% return in 2020.

S Fund

The S-fund stands for the “Small-cap stock Index investment fund”, where the goal of the fund is to match the performance of the Dow Jones U.S. Completion Total Stock Market Index.

The S-fund works to fill the gaps that the C-fund creates. While the C-fund focuses on holding all of the major businesses in the US, the S-fund brings you the high returns of smaller businesses, as well as more diversity.

This fund should compose part of your TSP portfolio, somewhere between 10-20%.

43.73% return in 2020.

I Fund

The I fund stands for “International Stock Index Investment Fund”, where the goal of the fund is to match the performance of the MSCI EAFE (Europe, Australasia, Far East) Index.

The I-fund is great for adding diversification to your portfolio by not relying on the US economy. While the US economy has shown the greatest returns for a number of years now, it is a good idea to position yourself to gain from possible economic booms overseas.

This fund should compose part of your TSP portfolio, somewhere between 10-20%.

26.32% return in 2020.

Average Fund Performance

The table below shows the average 1 year, 10 year, and lifetime returns of all five funds:

| Fund Option | 1 Year Return | 10 Year Average Return | Lifetime Average Return |

| G Fund | 1.15% | 1.94% | 4.75% |

| F Fund | 0.12% | 3.41% | 6.01% |

| C Fund | 31.13% | 16.36% | 11.30% |

| S Fund | 43.73% | 15.59% | 10.71% |

| I Fund | 26.32% | 7.68% | 5.56% |

Lifecycle Funds

The lifecycle funds are all simply compositions of the 5 funds (G, F, C, S, & I) listed above. With these funds, you will pick a lifecycle fund based on the year you expect to retire. For instance, if you wanted to retire in 2062 or later you would invest 100% in the L2065 fund.

One important aspect of these funds is that it makes no sense to hold both individual funds (G, F, C, S, I) and lifecycle funds at the same time.

You will either need to decide for yourself whether to set your own allocations and modify them over the years or put 100% of your TSP assets into the lifecycle that you feel best approximates your retirement.

Lifecycle Fund (PROS)

The lifecycle is perfect for individuals who have no desire to learn anything about the market or investing. Lifecycle funds let the “professionals” manage your TSP, while you can focus entirely on your job.

Lifecycle Fund (CONS)

Simply put, the lifecycle funds are a bit too conservative for many investors’ tastes. If you are looking to set your own allocation, the two most common recommended portfolios are:

- (80% C-fund / 10% S-fund / 10% I-fund)

- (60% C-fund / 20% S-fund / 20% I-fund)

Either of these allocations should earn you generous returns throughout your career.

Administrative Expenses

Administrative expenses are small reductions in your earnings in order to pay for those managing the portfolios.

The TSP has some of the lowest expenses of any 401(k) plans offered, with the total expense ratios ranging from 0.049%-0.068%. A 0.050% expense ratio would mean that for every $10,000 invested, you would pay $5 in fees. These low expense ratios help your account grow much faster by avoiding unnecessary fees.

How to Change Fund Allocations

In order to change your fund allocations, you must manually modify them on the TSP.gov webiste

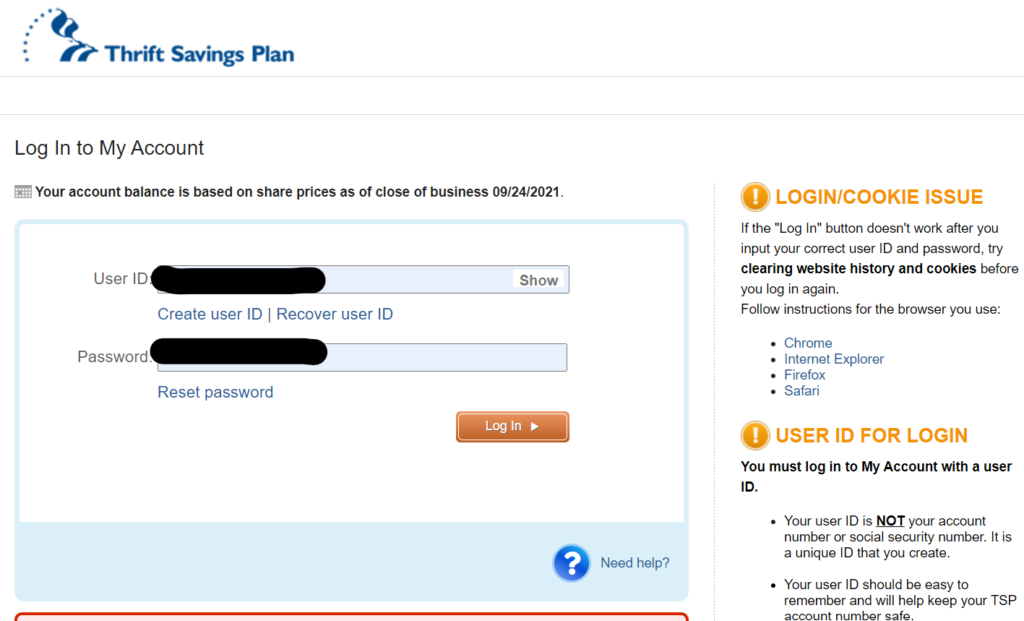

Accessing Your TSP.gov Account

In order to have your TSP.gov account info sent to your address, you must ensure that:

- You have updated your physcal address on myPay

- You have changed began contributing (takes 30+ days to go into effect)

- You have gone through a pay cycle where contributions were taken on your LES

Since you must wait until you have contributed money from your paycheck, it can take up to 4+ weeks before your information is sent. If you have done all of the three above steps, and waiting still hasn’t worked, you can call the TSP Thriftline at 1-877-968-3778 who is able to resend your information.

Step 1: Logging Onto myPay

Navigate to https://secure.tsp.gov/tsp/login.html

After that, enter the credentials that were sent in the mail. You will then need to enter the code sent to you by phone/email in order to ensure two-step verification.

Step 2: Navigate To ‘Contribution Allocations’

Simply click on the green highlighted section in order to modify your contribution allocations.

Step 3: Request Contribution Allocation

Next, click the orange button, ‘Request Contribution Allocation’. This will take you to a screen where you can modify which funds you wish to contribute to. Keep in mind, this allocation will only affect FUTURE contributions. If you want to change the allocation of money you have already contributed, you need to repeat the same steps from the button, ‘Interfund Transfers’.

TSP Withdrawals

In order to withdraw money from your Thrift Savings Plan, you must either conduct an ‘age-based’ withdrawal, or a ‘financial hardship’ withdrawal.

Age-Based:

- Must be 59.5 or older

- No reason needed for withdrawl

- Up to 4 withdrawls allowed per year, 30 day minimum between withdraws

These are the most common types of withdrawals, and what you should plan on using for your retirement.

Financial Hardship:

- Must meet financial hardship criteria (Legal fees, Medical expenses, House loss, etc.)

- Withdrawl can only occur once every 6 months

You should do everything in your power to avoid a financial hardship withdrawal. This should only be used as a true last resort, and every other potential plan considered. The 10% penalty, along with added income tax (if Traditional TSP), can decimate your account balance.

Loan Program

Another way to access the money in your TSP account is through a TSP loan. While I would still advise against TSP loans, if it prevents you from conducting a financial hardship withdrawal, it’s the lesser of two evils. Please note, separated/retired participants are not eligible for TSP loans.

General Purpose Loan

- Employee may only have one active general purpose loan at a time

- Minimum loan amount : $1,000, maximum loan amount: $50,000

- Minimum loan term: 1 year, maximum loan term: 5 years

- May only be loaned money equal to account balance

Primary Residence Loan

- Employee may only have one active primary residence loan at a time

- Minimum loan amount : $1,000, maximum loan amount: $50,000

- Minimum loan term: 1 year, maximum loan term: 15 years

- May only be loaned money equal to account balance

Both loans incur a $50 processing fee per loan. The loan is paid through payroll deductions, and the interest rate is equal to the return rate of the G-fund. Once payment on the loan is complete, an applicant must wait 60 days before applying for a loan of the same type.

The benefit of taking a loan over a financial hardship withdrawal is that you both avoid the 10% penalty, and are able to put the money used back into your tax-advantaged retirement account!

Payment At Death

In the unfortunate case that you pass away, the unpaid balance will be given to whichever beneficiaries you designated. If no beneficiaries were designated, then it will follow the following order of precedence:

- To the widow / widower

- To any surviving children or descendants

- To any surviving parents

- To the court-appointed executor / adminstrator of the estate

- To next of kin as determined by state-law

Building Wealth

Understanding how to leverage the power of your TSP is an important step to building wealth, but it’s not the only one.

If you want to learn more about other programs like the Thrift Savings Plan (TSP) / VA Home Loan that make the military a financially lucrative career, go check out other posts on my blog. If you want to understand the other critical elements to find financial success, check out our completely free guide on the six steps to build wealth.

As always, if you have any questions regarding your own personal financial situation, or have an awesome idea for an article idea, feel free to reach out!